Background

On September 9, 2025, following late-night discussions with our principal investors, the Interchained team revisited the structure of the Governance Pool and its allocations. The meeting focused on budgets, circulations, and the pressing need to secure exchange listings while maintaining ITC’s long-term sustainability.

The Governance Pool — representing 51% of total ITC supply — has always been designed to fund three critical pillars of the ecosystem:

-

Ambassadors, who spread adoption and build the community.

-

Investors, who provide the capital necessary to secure listings and infrastructure.

-

Liquidity, to back ITC market depths on exchanges.

With exchange listings underway and liquidity requirements increasing, leadership determined it was necessary to rebalance allocations while keeping fairness and transparency at the forefront.

The Proposal

After protecting the IGP pool overnight, leadership outlined the next steps in an announcement to the community:

“We have to do the following:

A) Make room for our principal investors to return capital for exchange listings.

B) Supply liquidity to exchanges and meet requirements.

C) Protect our ITC value from runaway inflation.”

To achieve this, the proposal introduced a percentage-based cap on Ambassador Rewards, mirroring the structure of the Miner Rewards Pool. This mechanism ensures ambassadors remain a core pillar of the network while avoiding runaway allocations that could harm ITC’s market value.

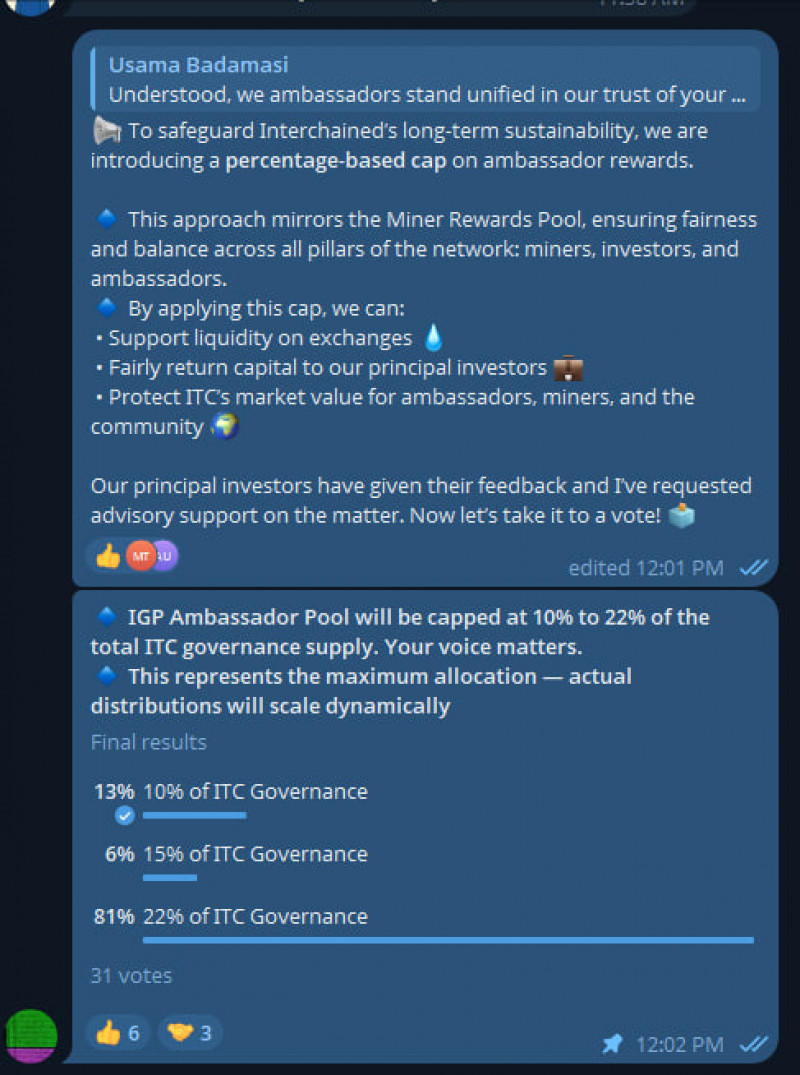

A poll was launched, offering three options for the cap: 10%, 15%, or 22% of the Governance Supply.

Community Debate

Ambassadors immediately engaged in thoughtful discussion:

-

Usama Badamasi emphasized unity and trust in leadership while requesting clarity:

“So that means ambassadors will only receive 10% to 22% out of the current pool? Or is the entire 51% being reduced?”

-

Muhammad Yunusa pointed to transparency as a strength:

“Transparency like this is exactly what keeps the community strong. Backing principal investors, securing liquidity, and protecting long-term value shows clear vision.”

-

Muhammad Sabo added:

“Great move! Prioritizing investor confidence, liquidity supply, and ITC stability shows strong leadership. Protecting value while preparing for exchange listings is the right strategy forward. ????????”

Other ambassadors, including The_onlyLio and OxBazzah, echoed support, noting that balancing liquidity and investor trust would make ITC stronger and more sustainable.

Leadership Clarification

To remove doubt, leadership explained:

“Out of the 51% ITC Governance Pool, the Ambassador Pool will now be capped at a maximum of 22%. This isn’t about cutting the governance pool itself — it remains 51% — but ensuring balance. We must:

???? Return capital to our investors who fund the early stages.

???? Provide liquidity to exchanges so ambassadors always have deep markets behind their work.

???? Reward miners and ambassadors fairly, as two equal pillars of the ecosystem.”

This clarification confirmed that ambassadors remain central to ITC’s future while ensuring the network honors commitments to investors and liquidity providers.

The Vote

The poll was open to the community, with the following options:

-

10% of Governance Supply

-

15% of Governance Supply

-

22% of Governance Supply

Throughout the day, ambassadors voiced strong support for fairness, sustainability, and balance. Dern Uxterx summarized it well:

“Clear structure, strong fundamentals. Balancing investors, liquidity, miners, and ambassadors is how ITC avoids the pitfalls of inflation and favoritism. 10–22% dynamic Ambassador Pool keeps incentives sharp while ensuring long-term sustainability. Fair, transparent, and growth-aligned — that’s how movements last.”

As votes came in, consensus formed around the higher ceiling.

Outcome

At 2:50 PM EDT on September 9, 2025, the poll officially closed.

Results:

-

The Ambassador Pool is now capped at 22% of the Governance Supply (maximum allocation).

-

The Governance Pool remains at 51% of total ITC.

-

Ambassadors will continue to be rewarded dynamically, up to the 22% cap.

-

The remainder of the Governance Pool will support principal investors and exchange liquidity, ensuring ITC markets remain strong and sustainable.

Leadership added:

“The 22% cap is fair in context. That share is close in value to what miners receive from their rewards — keeping balance between ambassadors and miners. Both pillars remain strong, and ITC grows on a foundation of fairness.”

Closing Thoughts

The Ambassador Pool cap decision demonstrates Interchained’s commitment to transparency, balance, and sustainability. By aligning ambassador rewards with miner incentives, honoring obligations to investors, and securing liquidity for exchanges, ITC is positioned for long-term growth.

The vote shows that governance in Interchained is not just a principle — it is an active, functioning system where voices are heard, decisions are debated, and outcomes are chosen collectively.

Together, ambassadors, miners, investors, and the broader community are building a resilient foundation for Interchained’s future.